In recent years, although it has been robbed of customers by "cheap SIM" and "cheap mobile phone", it has also been influenced by the guidance of the Ministry of General Affairs. Although it is a large operator with a clear-cut stand, looking back this year, although individual topics of each company still exist, it also puts forward a new direction in terms of cost planning and sales measures. It can be said that it has intensified the reversal offensive in a year.

まず、MVNO各社との戦いで、ユーザーからももっとも比較される料金面については、やはり、NTTドコモとauの料金プランが挙げられる。NTTドコモは今年5月、従来から展開してきた「カケホーダイ&パケあえる」のシェアパック向けプランとして、月額980円の「シンプルプラン」を追加した(※関連記事)。これは通話定額がない基本プランだが、データ通信はシェアパックになるため、すでにNTTドコモと契約しているユーザーは、月額1780円で回線が追加できるというものだった。本来は子どもなど、家族用に新規に回線を追加することを狙ったものだが、月額1780円という料金は多くのMVNO各社の3GBのデータ通信が可能な音声プランとほぼ同額であるため、実質的には『MVNOキラー』とも言えるプランだった。しかも端末購入に伴う月々サポートが適用されると、機種によっては月々の支払い額がマイナスになってしまうほどのインパクトを持つ(端末代金の負担はあるが……)。

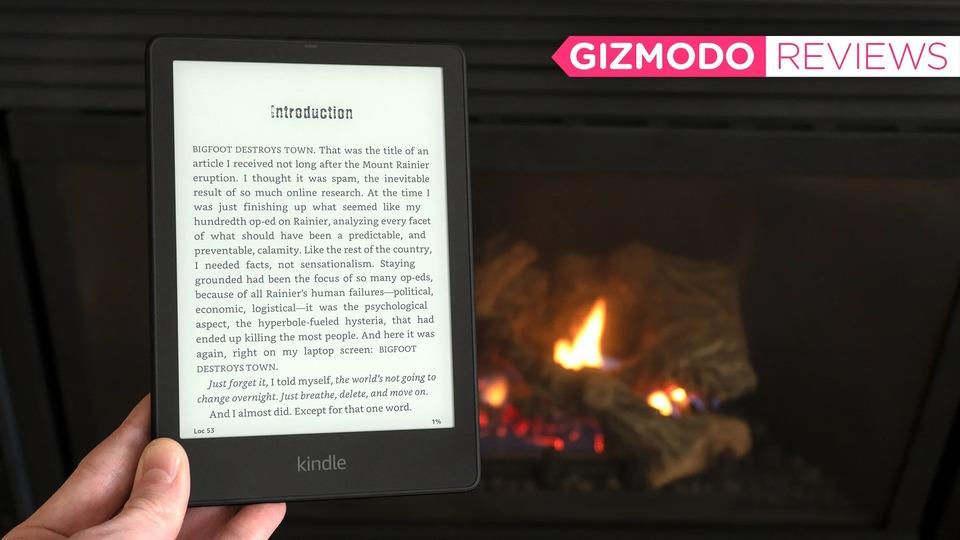

発表時に示された「シンプルプラン」の料金例In addition, NTT DoCoMo unveiled a new discount service, "docomo with", at the 2017 summer model launch in May. Instead of purchasing support such as not applicable monthly support, when purchasing the target model, as long as it is not changed to a model other than the object, the price will be reduced by 1500 yen per month, with 2 additional models in summer and 3 additional models in winter and spring. In total, you can choose from 5 models.

The models that have become the target models also have certain restrictions on the delivery price of the NTT DoCoMo. Manufacturers have worked hard on specifications and launched cost-effective models of about 30, 000 yen. Docomo with is originally a beneficial plan for long-term terminal users, but the condition of "continuing to use the target model" is only a topic on the login of NTT DoCoMo. If you give up the purchased terminal, you can continue to offer a discount even if you use your own SIM card free smartphone. It is also suitable for MVNO-oriented users who want to use SIM-free smartphones.

In July, au released "au Pitha Plan" and "au plane Plan" which are completely different from the traditional plan. The new plan is based on a cheaper fee plan that does not apply to the monthly offers that accompany terminal purchases, the au Pitat plan is based on the phased data quota introduced in this year's student offer, and the au flat plan is available as a high-volume plan with 20 GB and 30 GB of data traffic. Because the traditional plan is also provided in parallel, but unfortunately, it is difficult to calculate the gains and losses. The au Pitat plan is to meet the monthly changes in users' data traffic, and the au flat plan to some extent every month. Users who use data communications provide full use of data traffic, which is combined with promotional activities to create a sense of cheapness in an attempt to compete with MVNO companies.

For NTT DoCoMo and au, Softbank Corp. doesn't seem to have made any eye-catching moves. Way Mobile, launched as a sub-brand, has also launched a fierce sales competition in MVNO and sales stores, leaving a clear impression of the focus there this year. By the way, the cash return war between the companies last year and the year before last has become a topic. Recently, Y Mobile SIM cards are only issued (new contract), cash return and other measures are reported in the store, a lot of promotion funds can not be invested by MVNO companies. This is a very troublesome existence.

The offensive of such mobile phone companies is only beginning to infiltrate the market, and in the future, it is easy to imagine that MVNO companies will be forced into a more serious situation than ever before when the time for users to change their phones for a week. Sure enough, the differences in financial capacity and the positions of borrowers and borrowers are all difficult.

Because of this, at this time, Rakuten will raise its hand to participate in the allocation of the reorganized 1.7 GHz/3.4 GHz band, and the Ministry of General Affairs also wants to introduce new regulations at the "Seminar on promoting Fair Competition in the Mobile Market". They are all very concerned about the future trends, and I would like to explain them in other opportunities.