Now, there is a fast fashion brand that has been secretly attracting attention from the US (and Japan) Z generation.Shein is born in China around 2014 and is growing rapidly.

いわゆるプチプラ(プチ・プライス、低廉価格の意味)商品として人気を集めており、ZARAやH&Mを脅かしつつあるSheInの存在は、もはや中国企業がインターネット・テクノロジー領域だけではなく、アパレルや食品などでも台頭する未来を予感させている。

また新疆ウイグル自治区の綿花(コットン)をめぐって、中国政府がH&Mを批判する中、アパレル業界も政治的リスクから無縁ではないことが分かったが、中国発のグローバル企業の存在は、この問題をより複雑にしていくだろう。

What kind of company is SHEIN, where major VCs such as Sequoia Capital and Tiger Global have invested and rumors in preparation for listing?

What kind of company?

The brand and operating companies called SHEIN are often unknown.This is because the company carefully avoids media exposure and PR, and there is not enough public information, associated with being a Chinese company.And interestingly, many Chinese have never heard of this brand.

So who is buying Shein?

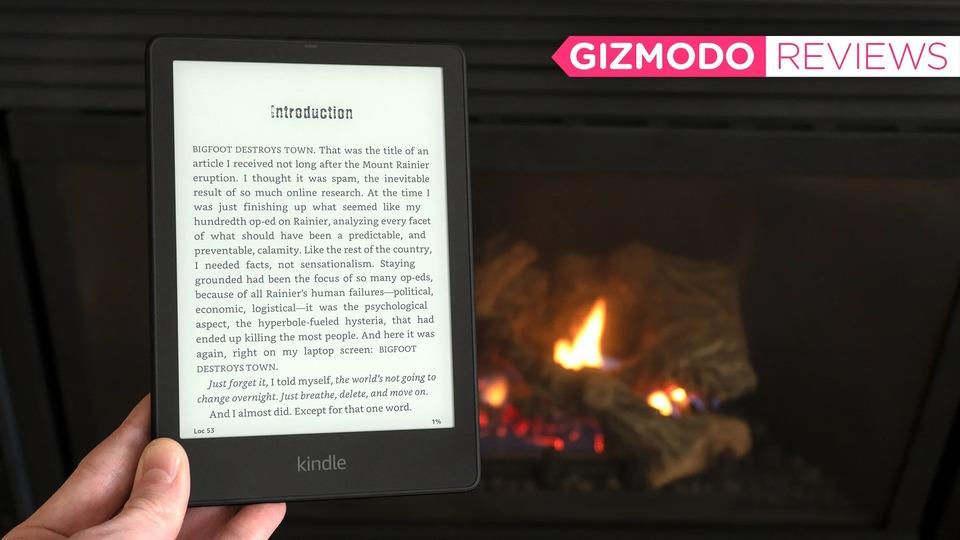

SHEIN's US site (screenshot)

What is Shein?

SheInは、2014年に誕生したファストファッション・ブランドだ。ファストファッションといえば、ZARAやH&M、GAPなどが知られており、UNIQLOの名前が加えられることもある。

Generally, fast fashion refers to a business format that puts items one after another in line with the latest trends, and it is said that UNIQLO, which is mainly basic items, is out of its definition.Shein is developing a business in which the word "fast fashion" is defined.

As will be described later, the company's strengths are the speed of the cycle from planning to sales, the number of products that are in large quantities, and incredibly low prices.As a result, SHEIN is now a popular brand in the United States, the Middle East, and Europe.In the Chinese international brand list, Shein ranked 14th, along with Huawei (Huawei), Bytedance (Tiktok operator), Alibaba, and Xiaomi (Xiaomi).

As mentioned earlier, SHEIN is hardly known in China, but in the United States, he is ranked second in EC sites that his teenagers like high -income households.As of April 4, their Instagram has more than 18 million followers, and has been supported by fans around the world, including the United States.

Shein's operating company, Nanjing Kono, a company, is a company based in Nanjing, Jiangsu Province, founded in 2008 in 2008.

The founder, CHRIS XU, Yangtian Xu, was born in the United States, graduated from the University of Washington, worked in the marketing department of Nanjing AODAO online transactions, and started the company.

Initially, he started a business related to SEO, and then started a business to sell wedding dresses online.At this time, it was mainly selling on Amazon and EBAY, like Chinese companies that develop many cross -border ECs.

In 2012, the company, who decided to sell Ladies Apparel, decided to prepare an EC site in -house, and started the brand under the name Sheinside.The strategy was successful by actively utilizing SEO and SNS advertisements, and from around 2015, it continued to expand through the acquisition of other companies in the same industry.In addition to acquiring ROMWE, which is still operated as a sub -brand, and Makemechic, which was closed in 2019, he also tried to acquire a Topshop (top shop) where British operating companies broke down.

Around 2017, it began to succeed in the Middle East Market, where many competitors have struggled due to the difficulty of delivery, and has entered the Indian market.It is said that the sales composition in 2018 was 30 % in the United States, 20 % Europe, and 20 % in the Middle East.

SHEIN's sales are growing rapidly.Sales, which were 1 billion yuan in 2016, reached 3 billion yuan in 2017, 8 billion yuan in 2018, and reached 16 billion yuan (about 330 billion yen) in 2019.In 2020, sales exceeded 40 billion yuan as of June and 100 billion yuan per year (about 1).It is expected to reach 68 trillion yen).By the way, it is difficult to compare with a large pandemic blow, but the recent sales of major apparel brands are as follows.

There are also predictions that operating income is 8 % and EBIT is 6 %.As with many e -commerce sites, SHEIN also has a large advertising budget, so the profit margin may change significantly depending on this cost, but it is growing strongly in the fierce competition online apparel market.Is no doubt.

With the rapid growth, investors are increasingly attracting attention.The company has been investing in JAFCO ASIA, IDG Capital, SEQUOIA CAPITAL, Tiger Global, etc., and is said to have completed the financing of the series E -round with over 15 billion dollars.Until now, it has been funding in 2013, 2015, 2018, the end of 2019, and 2020, and has become a decacone company that refers to a huge unpopular company with an evaluation of over $ 10 billion (Unicorn 10).Double).

The company's secretism has been thoroughly intended to investors, and even influential research companies such as Crunchbase and CB Insights have missed the company's unicorn.

The secret of four growth

SHEIN's steep length is broadly explained from four points.

The first point is the speed from product design to production.ZARA has a minimum of 14 days, but SHEIN has been holding down in seven days, aiming to shorten it to three days.

The feature of fast fashion is that the traditional apparel brand that takes about three months to sell products is made from trendy catching up and sales results, and significantly enhances the process from planning to production.It is compressed.SHEIN succeeded in increasing this cycle further without having a store.